The payroll in Panama is the fundamental document that details the payments and deductions that workers receive. Understanding how it is calculated and which laws regulate deductions is essential for employers and employees.

What is the spreadsheet?

The payroll is the official record where the salaries, bonuses and deductions of each employee in a company are documented. In Panama it is mainly regulated by the Article 161 of the Labor Code.

Main payroll discounts

- Social Security (CSS): The employee contributes 9.75% and the employer 12.25%.

- Education Insurance: The worker contributes 1,25% and the employer 1,50%.

- Income Tax: It is deducted according to the progressive scale established by law 15% from the surplus that exceeds 11,000.00

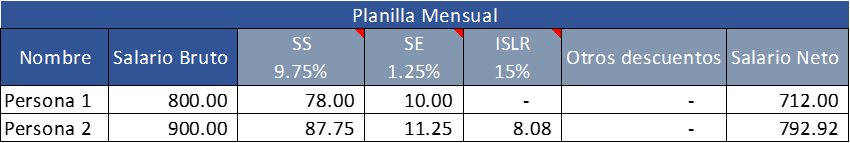

Example: Let's use two comparisons in this case we will use two workers with different salaries in a practical way on how the payroll is handled in Panama.

In the example we can see the salaries and deductions of the employees according to their salary, in the case of the first person he does not pay income tax because his annual income does not exceed 11,000.00 per year.

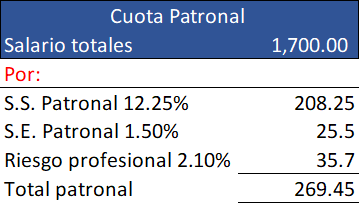

Employer's contribution: Below, we will show the calculation of the mandatory employer contributions established by the Organic Law of the Social Security Fund (Law 51 of 2005 and its amendments).

The Professional Risk Insurance in Panama is established on the basis of the Classification and Degree of Risk of the economic activity of the company and is obliged to be paid by the employer.

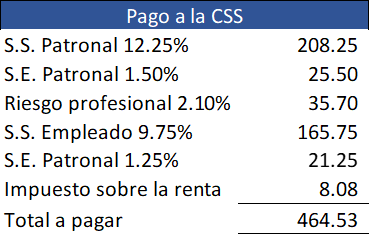

Total amount to be paid from our example:

Obligations and Payment:

- Employer: He is responsible for retain the employee's portion of his or her salary and of add their own employer's share.

- Payment: The employer must make the total payment (workers' contribution + employer's contribution) on a monthly basis to the Social Security Fundusing the System of Income and Economic Benefits (SIPE) of the CSS.

Authorized or Mutually Agreed Discounts (with Limits)

These deductions are also permitted by Article 161, but generally have maximum limits based on a percentage of the salary earned in the respective pay period:

- Wage Advances or Overpayments to the Employer: The discount cannot exceed 15% of the accrued salary.

- Bank Loans and Commercial Loans: The sums authorized by the employee may be deducted up to a maximum of 20% of his salary. These authorizations, once given, are irrevocable and binding on the employer.

- Purchase of Residential Homes (Housing):

- Monthly installments to the selling entity or a lending institution: up to 30% of the salary.

- Special note: There are laws that can extend this margin (up to 75%) if the loan is for housing and is duly certified by the competent government entity (such as MIVI, formerly known as the Ministry of Housing).

- Lease of Housing (with certain conditions): Up to 30% of his salary, when the lessor is an official institution or a private individual subject to the fixing of maximum fees by the competent authorities.

- Credit Sales of Company Products: Provided that it does not exceed 10% of the salary.

- Dues for Cooperative Associations, Savings Associations and Workers' Banks.

- Ordinary and Extraordinary Union Dues.

Other Discounts Ordered by Competent Authority

- Alimony: Payment in favor of those who have the right to demand maintenance, provided that the discount is decreed and ordered by autoridad competente (Juzgado).

- Embargos: El excedente de las cuantías inembargables del salario puede ser embargable hasta en un 15%, si es ordenado por una autoridad competente.

Reglas Importantes Adicionales

- Protección del Salario: El Artículo 161 establece la naturaleza restrictiva de las normas de protección al salario, lo que significa que cualquier descuento no contemplado en la ley es ilegal.

- Suspensión de Descuentos en Diciembre (Ley 64 de 1961): Existe una ley que ordena suspender los descuentos por préstamos y embargos (no las deducciones de ley como Seguro Social e ISR) durante el mes de diciembre para ayudar a los trabajadores con los gastos de fin de año (Día de la Madre, Navidad).

Es importante que tanto empleadores como trabajadores revisen siempre el comprobante de pago para asegurarse de que las deducciones se realicen correctamente y dentro de los límites legales. Ante cualquier duda o disputa, el Ministerio de Trabajo y Desarrollo Laboral (MITRADEL) es la entidad competente en Panamá

Los cálculos de planilla es recomendable que los manejen personas con el conocimiento certero de la legislación ya que un mal calculo de ellos puede causar problemas legales, que pueden terminar en pagos de remuneraciones extras y recargos a los empleados y en caso mas graves hasta posibles multa por la autoridad competente de su fiscalización.

De tener dudas sobre este tema o algún otro que observes en nuestra pagina no dudes en contactarnos estamos para brindar apoyo a tus inquietudes y brindar nuestros servicios.